Table of Contents

If your homeowners insurance claim was denied, it can feel frustrating and expensive all at once. A burst pipe, roof leak, or hurricane damage can push families into tough choices about repairs and temporary housing. Insurers sometimes get it wrong, or they interpret your policy in a way that cuts off coverage you counted on. There are a number of reasons why homeowners insurance claims get denied, some of which might be due to bad faith insurance practices. Let’s unpack some of these reasons.

Why Homeowners Insurance Claims Get Denied

Insurance companies deny claims for a variety of reasons. Sometimes the denial is legitimate, such as when the damage truly falls outside the policy’s coverage. Other times, denials stem from unfair or technical reasons that leave homeowners frustrated and unsure how to proceed. Common causes of denials include:

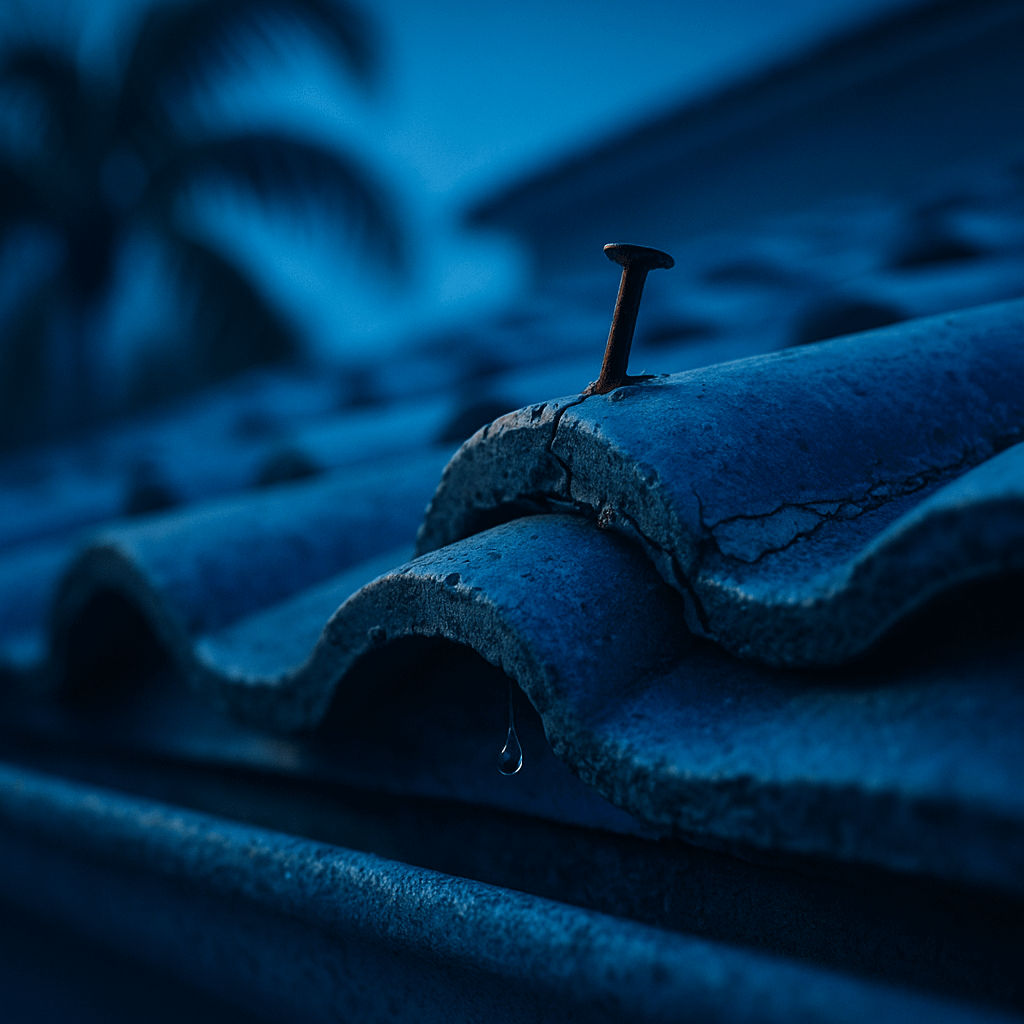

- Excluded Causes of Loss: Insurers may say the damage isn’t covered because the cause falls outside the policy, such as repeated water seepage instead of a sudden pipe break.

- Wear and Tear or Poor Maintenance: Carriers sometimes attribute damage to aging materials, lack of upkeep, or pre-existing issues, even when the loss was caused by a sudden covered event like a storm.

- Late Notice: Claims can be denied if the insurer believes the damage wasn’t reported promptly, making it harder for them to inspect and verify the loss.

- Incomplete or Inconsistent Documentation: Missing photos, repair estimates, receipts, or inconsistent statements can give the insurer a reason to reject the claim.

- Policy Interpretation Differences: Small wording differences or technical distinctions can affect coverage, such as limits on mold, ordinance or law coverage, or whether repeated damage qualifies under the policy.

- Bad Faith: Some denials go beyond technicalities and reflect deliberate unfair treatment, such as misrepresenting coverage or applying unreasonable depreciation.

Denials have real consequences for homeowners, with costs that can extend beyond just repair bills, especially when the damage prevents them from continuing to live in their home. Recognizing why the insurer denied the claim is the first step toward building an effective response and protecting your home.

What Are Your Rights as a Homeowner in Florida?

Florida law sets standards for how insurers must handle claims. The Unfair Insurance Trade Practices Act prohibits misrepresenting policy provisions, failing to act promptly, and offering settlements that are not reasonably based on the facts. Homeowners have the right to challenge a denied or underpaid claim whenever they believe their insurer’s decision is incorrect, and they may also take legal action when an insurer acts in bad faith.

Florida law also requires insurers to handle claims in a timely and transparent way. Insurers must generally acknowledge communications about a claim within seven days, conduct an inspection within 30 days, and make a decision within 60 days.

How You Can Dispute a Denied Homeowners Insurance Claim

If your homeowners insurance claim is denied, you have the option to appeal. The first step is understanding the insurer’s reasons for denial and gathering the necessary documentation, such as photos and videos of the damage, repair invoices, contractor estimates, receipts for out-of-pocket costs, and copies of your policy and denial letter. Keeping a detailed record of all communications with the insurer is also important.

Once your documentation is ready, an internal appeal can be submitted to the insurance company. This involves asking the insurer to explain which policy terms support the denial and presenting evidence to counter their position. Because insurers often interpret policy language in their favor, having a homeowners insurance attorney on your side can help ensure your appeal clearly addresses the insurer’s arguments, provides strong supporting evidence, and follows Florida-specific requirements.

If the internal appeal does not succeed, you may still have options, such as mediation through the Florida Department of Financial Services or requesting a formal appraisal. A lawyer can guide you through these processes, evaluate whether litigation is warranted, and represent your interests to maximize your chances of recovering the coverage you are entitled to.

Protecting Your Homeowners Insurance Claim

Many homeowners decide at some point to file a property damage insurance dispute claim, but unfortunately, some come to us when it’s already too late and the statute of limitations has passed. If you believe that you have a valid claim or your insurance adjuster might be lying to you, here is what you should do:

- Report damage as soon as reasonably possible. Under Florida law, you usually must notify your insurer of a new property claim within one year of the loss and any supplemental claim within 18 months of the date of loss. Delaying notice can jeopardize your coverage, even for valid losses.

- Document everything from the start. Before cleaning up, take clear photos and videos of the damage and preserve any damaged items the adjuster may want to examine. Keep all mitigation or temporary housing invoices, repair estimates from contractors, and any related receipts. Use email or other written records for communications with your insurer so you have a reliable trail.

- Take reasonable steps to protect your property from further damage. Emergency repairs such as tarping a roof, boarding up windows, or drying out water are generally covered. If you hire contractors, review any agreements carefully to make sure you are only agreeing to necessary repairs. When an adjuster inspects, try to be present or have someone there who can clearly explain what happened.

- Keep a clear and organized log of every interaction with the insurer. Record who you spoke with, when, and what was discussed, whether over the phone, in person, or via email. This documentation is helpful for your claim and can be critical if you need to appeal or involve legal support.

- Consider working with a trusted advocate or attorney early. Even though you can do a lot on your own, a Florida homeowners insurance claim attorney can review your policy, help you prepare your documentation, and guide you through appeals, mediation, or litigation if necessary. Having legal support can make a significant difference, especially with complicated or high-value claims.

Get Help From a Homeowners Insurance Claim Denial Attorney

A denial is not the end of the road. Florida law gives you tools to challenge unfair decisions, and the right strategy can turn a “no” into a proper payment. Acting quickly, documenting effectively, and understanding your policy and legal protections can make the difference. If you need an attorney for homeowners insurance claims, Levin Litigation can step in, analyze your file, and push for a fair outcome.

Contact us for a free consultation and learn more about how we can help.