Table of Contents

Home insurance (also known as homeowners insurance) is a form of insurance coverage that protects your property, personal belongings, and provides liability protection. A standard homeowners policy typically covers the physical structure of your home, personal property (including personal belongings), liability protection, and additional living expenses if your home becomes uninhabitable. Without homeowners insurance, you could face significant financial loss and be stuck paying out of pocket for major repairs. Homeowners insurance provides critical financial protection, whether you own your home outright or still have mortgage payments.

If you’re dealing with property damage, you may be unsure whether filing a homeowners insurance claim is the right move. It’s not always a straightforward decision. This guide walks you through how the claim process works, the potential benefits and drawbacks of filing, and what to do if your insurer pushes back. By the end, you’ll have a clearer understanding of your options — and when it makes sense to involve a homeowners insurance attorney.

How Does a Homeowners Insurance Claim Work?

A homeowners insurance claim is a formal request to your insurance provider to pay for a repair or replacement of covered damage. You can file a claim after things like a storm, fire, theft, vandalism, and other incidents. That is your trigger point: when your loss meets the policy’s covered event.

Here are the basics, step by step:

- You suffer a covered event.

- You contact your insurer (ideally within a few hours or days).

- An adjuster comes out to inspect the damages.

- You submit proof, such as photos, receipts, receipts for living expenses, etc.

- The insurer reviews, values the claim, and either issues payment, denies it, or requests more info.

Most mortgage lenders require homeowners insurance as a condition of your loan, and if you have a mortgage and cancel your policy, your lender may force-place an expensive insurance policy or declare your loan in default. Homeowners insurance is not legally required, but is typically required by mortgage lenders to protect their financial stake in the property.

Before Filing a Homeowners Insurance Claim

Before you decide to file a homeowners insurance claim, it’s important to weigh several key factors to make sure you’re protecting both your property and your financial future. Homeowners insurance is there to provide financial protection when you need it most, but not every situation calls for filing a claim. Here’s what to keep in mind:

The Deductible Test: Filing a small claim can sometimes cause your insurance rates to go up, costing you more money in the long run, so compare the repair cost to your deductible.

Know Your Coverage Gaps: Standard policies don’t cover everything. For example, flood damage almost always requires a separate policy. You should also check if your policy pays for the “replacement cost” to rebuild your home or just the “market value.”

Liability and Living Expenses: If a guest gets hurt at your house, your liability coverage pays for their medical bills and your legal fees. Additionally, if a disaster makes your home unlivable, your policy might pay for hotel stays and meals. Make sure you know the time limits on these benefits so you aren’t left with an unexpected bill.

Policy Management: You can lower your monthly premium by choosing a higher deductible, but you must have enough emergency savings to cover that amount if something goes wrong.

What are the Pros of Filing a Homeowners Insurance Claim?

It goes without saying that the greatest benefit of filing a homeowners insurance claim is financial relief. Whether it’s roof damage after a hailstorm or a theft claim after a break-in, insurance can help cover repair or replacement costs that might otherwise have a significant impact on your finances.

Filing a claim also puts a process in motion. Once it’s submitted, your insurer typically has deadlines—often set by state law—to respond, inspect the damage, and begin resolution. While a claim isn’t guaranteed to be paid out, starting the process can bring a sense of control and peace of mind at a time when things feel uncertain.

Finally, while not a “pro” in the traditional sense, filing a claim can also reveal potential gaps in your coverage. If you run into exclusions or find that certain losses aren’t fully covered, that experience can help you reassess your policy and make more informed decisions going forward.

Whether it’s roof damage after a hailstorm or a theft claim after a break-in, insurance can help cover repair or replacement costs that might otherwise have a significant impact on your finances.

What are the Cons of Filing a Homeowners Insurance Claim?

While filing a claim can provide essential financial support, it can also come with trade-offs. One of the most common concerns is the potential for increased premiums. Insurers may view you as a higher risk after a claim—especially if you file multiple times within a few years—and raise your rates at renewal. In some cases, multiple claims could even lead to cancellation or non-renewal, forcing you to find new coverage in a potentially more expensive or limited market.

Claims also stay on your insurance record for several years, making it harder to switch carriers without being flagged as loss-prone.

How to File a Homeowners Insurance Claim

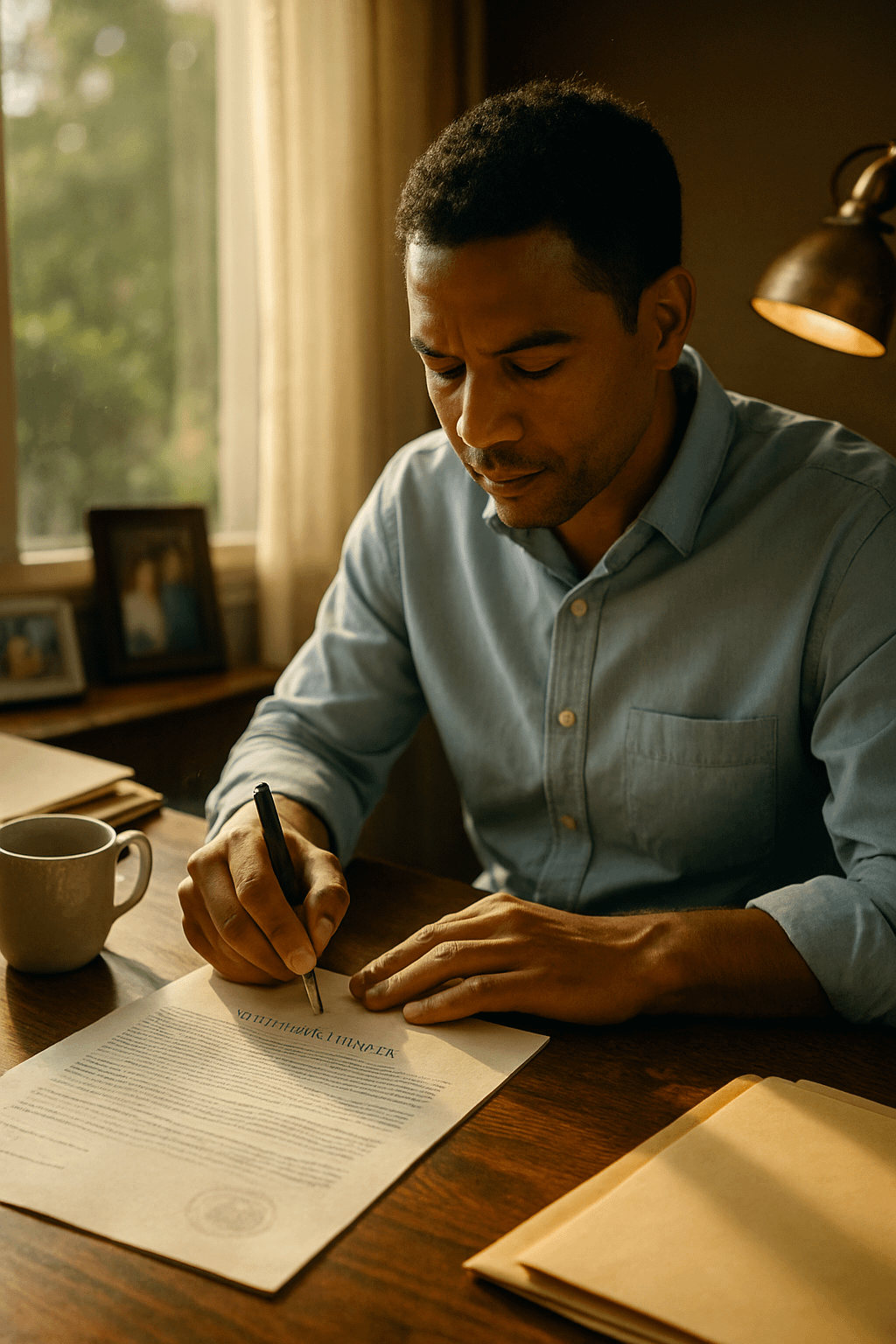

Filing a homeowners insurance claim can feel overwhelming, especially after a stressful event. To help you navigate the process smoothly, here’s a straightforward roadmap we recommend following step-by-step:

- Contact relevant authorities if there is criminal activity—like theft, vandalism, or a break‑in. In these cases, a police report may be required for your claim.

- Notify your insurance company right away. You can often do this through many different channels, such as by calling your insurer or using their app or website.

- Compile a damage list. Write down what was damaged or stolen. Be specific about the model, age, and estimated value.

- Document thoroughly. Gather photos, videos, receipts, and anything else that captures the full extent and context of the situation.

- File the claim and include your supporting documentation.

- Keep a record. Save correspondence, claim numbers, and dates of calls. This is especially important if your claim is unfairly denied or underpaid and you need to work with an attorney.

Following these steps can make the process less stressful and help keep your claim moving efficiently toward resolution.

What to Expect in the Homeowners Insurance Claim Process

After submission, here is what typically happens:

- Assignment of an adjuster. After you file a claim, your insurance company will assign an adjuster to it. The adjuster’s role is to assess your loss and determine how much the insurer should pay you. An adjuster will typically reach out to you within 24 to 48 hours. Make sure to not confuse an insurance adjuster who is hired by the insurance and does not represent you, with a public adjuster who you can hire to represent and assist you with your claim.

- Inspection and preliminary offer. The insurance adjuster will typically schedule a visit to your home, where they will evaluate the damage. Based on that evaluation, they’ll issue an estimate of what the repairs or replacements might cost under the policy. Keep in mind that this number is preliminary and may not reflect your final payout.

- Negotiation. You can and should push back if the estimate seems low or incomplete. This is especially important for larger claims, like those involving structural damage or roof replacement. A homeowner’s insurance attorney or public adjuster can help advocate on your behalf.

- Settlement. Once you have agreed upon the final amount, the insurer will issue a check or direct payment to contractors.

If you experience delays, vague communication, or a denied claim, document everything, ask for clarification, and don’t hesitate to seek legal help.

Is There a Time Limit to File a Homeowners Insurance Claim?

Yes. In Florida, you have one year from the date of loss to file a homeowners insurance claim and only 18 months to supplement an existing claim. In addition, your insurer has its own timelines under state law. They must acknowledge your claim within 14 days of filing, and they must decide whether your claim will be paid out or denied within 90 days of filing. If your claim is approved, they must issue payment within 20 days.

What If You Run Into Issues With Your Claim?

Sometimes things go wrong. You may encounter delays, lowball offers, or a refusal to cover a valid loss. If your homeowner’s insurance claim is denied or you receive no response, do not wait. Here is what you can do:

- Ask for a clear explanation. Policies should spell out why claims are denied—whether it is evidence, valuation, or coverage exclusions.

- Push for re‑inspection. A fresh set of eyes may spot what the first one missed.

- Get an independent estimate. Sometimes, insurers undervalue damage.

- Call us. If the insurer stonewalls you or offers far below what your policy promises, reach out for a consultation with a homeowners insurance claim attorney at Levin Litigation. We fight for fair compensation and hold insurers accountable.

Schedule a Consultation With a Homeowners Insurance Attorney at Levin Litigation

Filing a homeowners insurance claim can be your path to financial recovery, but it may also come at a cost. Before you take that step, weigh the pros and cons of filing a homeowners insurance claim. Sometimes, paying out of pocket for minor losses can avoid premium hikes or policy headaches. Other times, insisting on the full value of a covered loss is the right call, especially with legal support.

If you have questions about your policy, are concerned about a potential denial, or want to determine if filing is the right course of action for your situation, reach out to our team today. Our homeowners insurance lawyers can help you understand the options available to you and, if necessary, fight back against unfair insurance company tactics.