Table of Contents

Quick Answer

Sometimes insurance companies say no to paying for damage, even if you have been paying your premiums every month. They might say the damage is not covered, happened too long ago, or that you did not give them the right papers. Sometimes they wait a long time to answer or give you wrong information. Our property insurance dispute lawyers are here to help you when an insurer acts in bad faith. We will read your policy, gather the proof you need, and push the insurance company to pay what they owe.

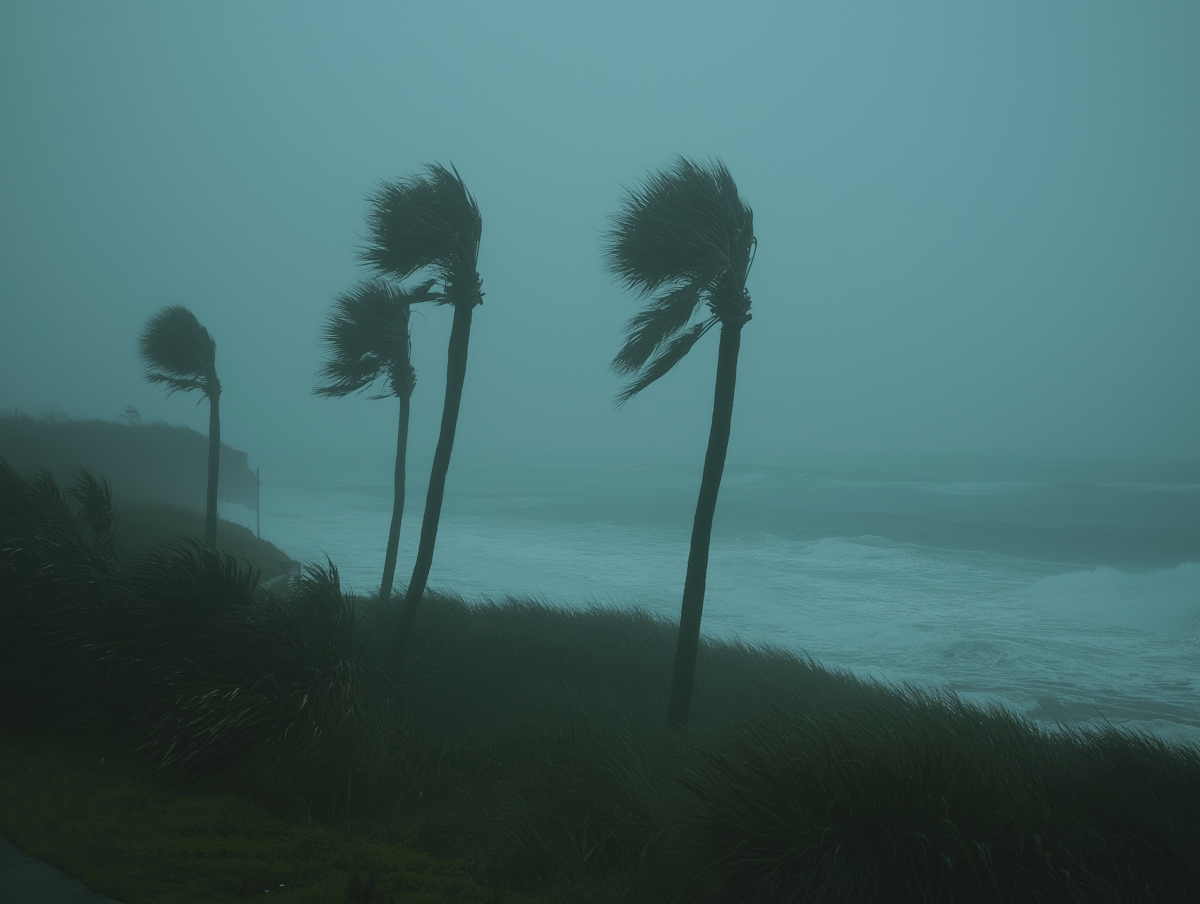

You pay for property insurance because you expect it to protect your home, your business, and your peace of mind. But when a natural disaster, plumbing emergency, or accidental fire causes real damage and the insurance company refuses to pay, it feels like the rug has been pulled out from under you. Denied claims, lowball offers, and unexplained delays are more common than most people realize. And while insurers are required by law to handle claims in good faith, not all of them do.

If your property damage insurance claim is being ignored, underpaid, or outright denied, you are not powerless. Whether you are a homeowner or a property owner managing residential or commercial real estate, you have rights and legal options. If your insurer is not holding up their end of the contract, our attorneys at Levin Litigation can help you fight back.

How Do Property Damage Insurance Claims Work?

Property damage insurance covers a range of unexpected losses, whether it’s damage to your home or a commercial building. While all policies are different, they often cover losses resulting from events like hurricanes, fires, pipe bursts, and certain types of water intrusion.

If your property is damaged, the claim process usually begins with notifying your insurer and submitting supporting documentation. An adjuster will likely be sent out to inspect the damage and estimate the cost of repairs. From there, the insurance company will either approve or deny your claim.

Residential and commercial claims are often handled differently, and business owners may also have to account for income loss or other operational disruptions.

Why Would a Property Insurance Claim Be Denied?

If your insurance claim was denied, there could be a number of reasons why, ranging from legitimate to unethical.

1. Alleged Lack of Coverage

Insurers may argue that the damage falls outside the policy’s scope. For instance, water damage caused by flooding (as opposed to a burst pipe) may be excluded unless you carry a separate flood insurance policy. Similarly, mold is often denied unless it stems from a covered event or condition.

2. Wear and Tear or Neglect

Carriers frequently deny claims by attributing damage to “normal wear and tear” or poor maintenance. This is especially common in older homes or buildings with outdated plumbing, roofing, or electrical systems.

3. Late Reporting

If you wait too long to notify the insurer, they may deny your property insurance claim on the basis that the delay prevented them from properly inspecting the damage. Florida law requires policyholders to report claims “promptly,” although the exact timeline for doing so is not always specified.

4. Incomplete Documentation

Insurers may also deny claims if the documentation is missing or inconsistent. That includes repair estimates, photographs of the damage, receipts for emergency mitigation work, or proof of loss.

5. Bad Faith Tactics

In some cases, the denial is not about coverage, it’s about tactics. Adjusters may misrepresent policy terms, delay inspections, or apply unfair depreciation calculations. If your property insurance claim is denied and the reasons do not seem reasonable, it is worth considering whether your insurer is acting in bad faith.

How to Fight a Denied Property Insurance Claim

So, how do you fight a denied property insurance claim? The first step is to understand exactly why your claim was rejected and get that denial in writing. Once you have the explanation, you can start building your response.

Step 1: Review the Denial Letter

Your insurer is required to provide a written explanation. Look for specific references to your policy, exclusions, and any alleged lack of documentation.

Step 2: Gather Your Records

Pull together all photos, repair estimates, invoices, and communications with the insurer. If you have a contractor assess the damage, their opinion can be helpful.

Step 3: Request a Reconsideration

In some cases, filing a formal appeal with additional documentation may be sufficient to overturn the denial. Your policy should explain how to initiate this process.

Step 4: Get a Second Opinion

Consider hiring a public adjuster. They can review the damage independently and identify whether your insurer’s position is justified.

Step 5: Consider Legal Action

If the insurer continues to delay or refuses to pay, it’s likely time to speak with one of our property insurance lawyers to escalate the matter. Florida law protects policyholders from unfair claim practices, and we can pressure the carrier to resolve things more quickly.

How Long Does a Property Insurance Claim Take?

According to Florida Statute § 627.70131, insurers have 14 days to acknowledge receipt of a claim and 90 days to approve or deny it. Once approved, payment must be made within 20 days.

The exact amount of time the claim takes depends on the nature of the damage. It can often take longer if the damage is extensive or if the insurance company raises questions about the cause. In fact, there are some situations, in the case of particularly complex claims, where the 90-day timeline can be extended.

If your claim has passed the 90-day mark without resolution, it could be for legitimate reasons, but it could also signal a potential bad-faith delay. When this happens, we recommend getting in touch with our firm as soon as possible. We can help determine whether the insurer is violating Florida law and advise you on your next steps.

When to Contact a Property Damage Insurance Claim Lawyer

You are not required to hire a lawyer to handle your property damage insurance claim, but there are situations where having legal counsel is not just helpful but essential.

You should consider calling a lawyer if:

- Your claim is denied, but you believe the loss is covered.

- You are offered far less than it will cost to repair the damage.

- The insurer is delaying communication or ignoring your calls.

- You are being unfairly blamed for the damage.

- You are unsure how to read or interpret your policy.

If your claim involves a commercial building, rental property, or other high-value asset, it’s especially important to get legal guidance early on. These cases often involve added challenges, like business interruption losses, lease disputes, or compliance with updated building codes, that can significantly complicate the claims process.

How Can a Property Insurance Claims Attorney Help?

Insurance policies are written to protect the insurer, not you. That is why it is critical to have someone in your corner who understands the games insurers play and how to stop them.

Here is what the property insurance lawyers at Levin Litigation can do to help:

- Review your policy to identify hidden coverage and exclusions

- Investigate the cause of damage using independent experts.

- Challenge the insurer’s interpretation of your policy.

- Negotiate a fair settlement or file a lawsuit if needed

- Hold insurers accountable under Florida’s bad faith laws

Prior to representing property owners, our attorneys spent years on the side of insurance companies, which means our team knows how they evaluate claims and how to push back when they cross the line.

Schedule a Consultation With a Property Insurance Attorney at Levin Litigation Today

When your property is damaged, you shouldn’t have to fight your insurance company for compensation. At Levin Litigation, we have helped countless Florida property owners navigate complex policies, uncover hidden coverage, and stand up to bad-faith insurance tactics.

If your property insurance claim has been denied, delayed, or underpaid, do not wait. Contact us today to schedule a free consultation with a dedicated attorney who knows how to hold insurers accountable.