Table of Contents

Why Legal Help Matters for Roof Leak Claims

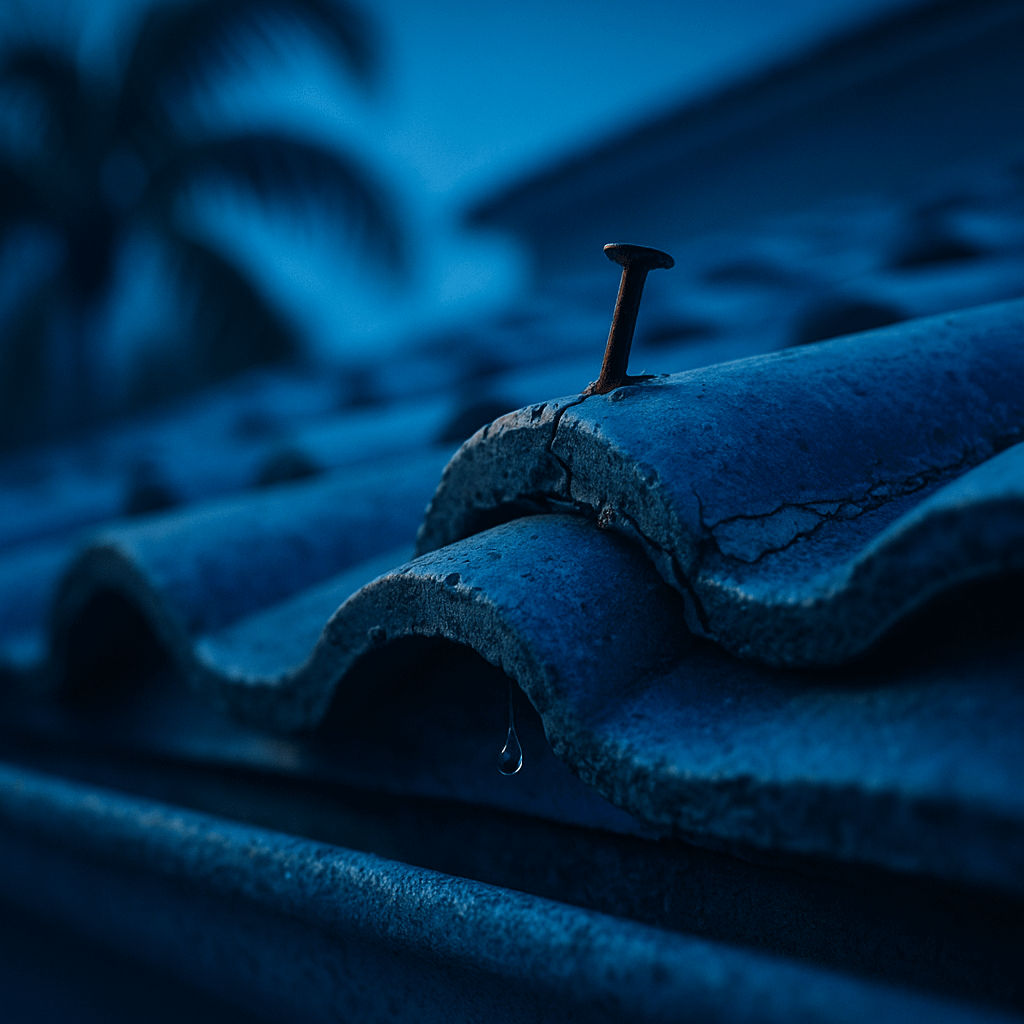

A roof leak may seem like a simple repair, but insurance claims for this type of damage are rarely straightforward. Disputes often arise over whether the leak was caused by storms, age, or poor maintenance, and hidden problems like mold or structural issues can add to the challenges. Insurance companies may try to pay less than what your repairs actually cost or deny coverage altogether. An experienced roof leak claims lawyer can review your policy, collect evidence, and handle tough negotiations so you have the best chance at a full and fair recovery.

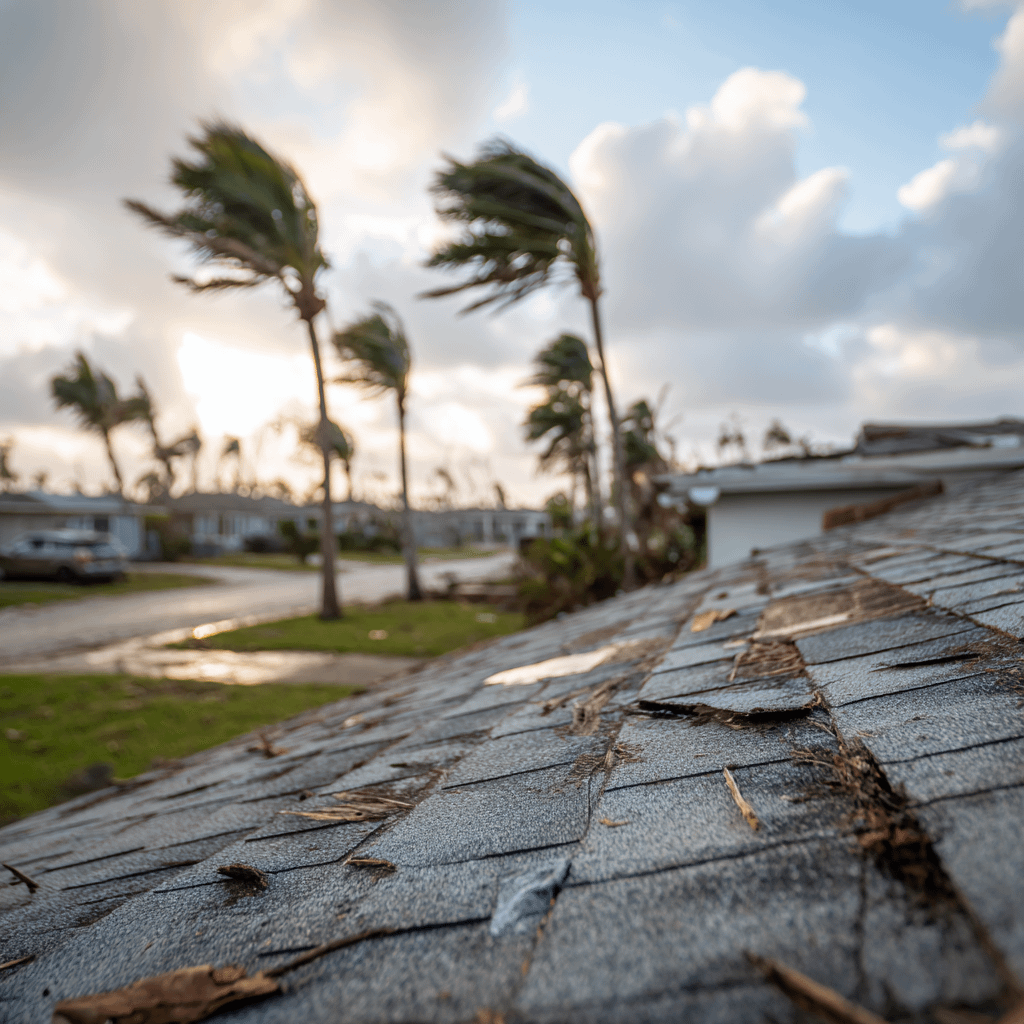

Roof damage is far from uncommon in the wet, windy, and humid conditions of Florida, but that doesn’t make addressing the damage any easier or cheaper. You’ll not only need to go through the headache of assessing the damage and coordinating repairs, but also handling your insurance claim. This last task can be one of the most stressful steps, especially when your insurance provider is unwilling to offer a fair settlement or avoids communication.

Fortunately, there are ways to make this process less challenging and emotionally taxing. Levin Litigation has helped thousands of Florida home and business owners overcome unfair settlement offers and denials. If you’re facing issues with your claim, contact us to find out how we can help.

Does Insurance Cover Roof Damage?

Florida property insurance policies generally cover roof damage caused by sudden, unexpected events such as hurricanes, severe storms, hail, falling debris, or fire. However, if the damage arose due to a lack of maintenance to the roof, it typically isn’t covered. That being said, even valid roof damage claims can hit unexpected roadblocks.

What Are The Most Common Challenges of Roof Damage Claims in Florida?

Filing a roof damage claim should be straightforward, but too often Florida homeowners run into obstacles created by their own insurance companies. Here are some of the most frequent challenges we help clients with:

- Denied Claims: Insurers may argue that the damage was caused by wear and tear, poor maintenance, or an excluded event. Other times, claims are rejected on technical grounds, like missing paperwork or not filing quickly enough.

- Delayed Claims: Insurers might drag out your claim by requesting the same documents over and over, assigning multiple adjusters, or avoiding your calls.

- Underpaid Claims: Even when insurers agree to pay, they often undervalue roof damage. You may receive an estimate that barely covers patchwork repairs when you actually need a full roof replacement.

How Can Levin Litigation’s Roof Damage Claim Attorneys Help?

Working with a roof damage lawyer doesn’t just signal to insurance that you’re serious about making sure your claim is handled fairly. There are a wide range of other benefits as well. When you work with Levin Litigation, you’ll be supported by a team of legal professionals who will give your claim the attention it needs and step in if any potential issues arise. Here’s what you can expect:

- Claim evaluation: During your free consultation, our team will start by carefully reviewing the details of your roof damage and any prior claim activity to determine the strength of your case.

- Policy review: Once we have a solid understanding of the situation, we will review your insurance policy to identify coverage, exclusions, deductibles, and any legal obligations you must meet.

- Evidence collection: Following a careful review of your policy, we will organize all relevant documentation, including photos, estimates, inspection reports, and expert opinions, to support your claim.

- Professional communication: At every stage of the process, we handle all interactions with the insurance company on your behalf to prevent misunderstandings, delays, or manipulation. Our team will also apply the same professionalism when keeping you updated on the status of your claim.

- Settlement negotiation: If you are faced with a denial or lowball offer, we will prepare and submit our case to your insurance provider and advocate for a fairer settlement. If needed, we are prepared to pursue other options as well, including filing an appeal or taking your case to trial.

Why Roof Claims Are Denied, Delayed, or Underpaid

Roof damage claims can run into problems for several reasons. Insurers may deny a claim by citing policy exclusions, like wear and tear or lack of maintenance. Claims can also be rejected due to technical issues, like missed deadlines or insufficient evidence.

In other situations, insurers may attempt to draw out the claim process, hoping to frustrate policyholders and make them more likely to accept a lower offer. Meanwhile, underpayments can occur when the insurer narrowly interprets policy terms or downplays the severity of the damage.

All these tactics are designed to preserve insurers’ bottom line and leave you to bear the brunt of the expenses. Levin Litigation can help you identify and counter these tactics so that you can recover the compensation you rightfully deserve.

Insurance companies often use underhanded tactics to preserve their bottom line and leave you to bear the brunt of the expenses.

Florida Roof Damage Lawyer: FAQs

How Long Do I Have To File a Claim For Roof Damage?

The Florida statute of limitations for property insurance claims is one year from when the damage occurred. However, you may have less time to file depending on your specific policy guidelines. Regardless, it’s best to file as soon as possible, as evidence and documentation may be lost if too much time has passed.

Does Roof Insurance Cover Mold Damage?

Possibly. If the mold was caused suddenly due to unexpected damage to your roof, your policy may cover it. However, in these cases, insurance companies will often claim that the mold developed over time due to neglect. You’ll want to make sure that the damage to your roof is documented as it progresses and to notify your insurance as soon as you notice it.

How Much Does an Insurance Premium Go Up After a Roof Damage Claim?

It typically depends on the number of claims filed over time. For example, a policyholder who makes several roof damage claims within the same year will likely see their premiums go up substantially. For first-time claimants, the increase may be much smaller, or there may be no increase at all.

Can I Claim Roof Damage if My Roof Leak Happened a While Ago and I Fixed it Myself?

It’s possible, but you may face pushback from your insurance. They may claim that you were not experienced enough to make the repair yourself or that your repair made the damage worse. However, if you have extensive documentation of the repair, you may be able to show otherwise. This may include pictures of the repair over time, as well as receipts for the supplies used. You’ll also want to review your policy to make sure the filing deadline has not passed.

Have More Questions? Speak To a Roof Damage Insurance Claims Lawyer Today

Being faced with roof damage can be incredibly stressful, but as we’ve learned, it’s important to address the damage and your claim as quickly and thoroughly as possible. Regardless of where you are in the process, Levin Litigation can offer you attentive and experienced support at every step. Whether you have a simple question or need help filing your claim or appeal, we can help get you the settlement you deserve and protect you from potential future financial losses. Contact us today for a free consultation.