Table of Contents

Citizens Property Insurance Corporation (Citizens) was created as Florida’s insurer of “last resort”, meant to provide property coverage when private insurers exit the market. While Citizens can be a necessary option for some homeowners, its recent shift away from civil courts and into the Division of Administrative Hearings (DOAH) has raised serious constitutional concerns.

Let’s unpack this below. In the meantime, if you are suffering from a homeowners insurance dispute due to an unfair denial or delay, don’t hesitate to speak to our legal team.

How Does Citizens Insurance Work in Florida?

Citizens is a state-created insurance entity, not a traditional private insurer. Its primary mandate is to ensure the availability of coverage when the private market is unwilling or unable to provide it. Because it is a “market of last resort,” Citizens does not compete for your business based on customer service or policyholder advocacy; rather, its role is to maintain the state’s financial stability.

From a legal standpoint, this distinction is critical. Because Citizens operates under a unique statutory framework, it possesses special protections that private companies do not. These benefits become especially important when your home insurance claim is denied or disputed.

Is Citizens Homeowners Insurance “Good” When a Policyholder Files a Claim?

For many policyholders, the reality of the Florida property insurance market becomes clear after a loss occurs. Many homeowners frequently report that the “safety net” feels more like a legal hurdle. As practitioners in Florida state insurance laws, we see recurring patterns where Citizens uses its statutory status to challenge or delay legitimate payouts.

Common issues reported by homeowners include:

- Claim denials based on alleged wear and tear

- Disputes over causation following hurricanes or storms

- Delayed inspections and prolonged investigations

- Narrow interpretations of coverage exclusions

However, the most significant concern today is how Citizens forces disputes out of Florida’s civil courts and into administrative proceedings.

DOAH Dispute Resolution: A Fundamental Shift Away From the Courts

In recent years, Citizens has implemented policy provisions that require certain disputes to be resolved before the Division of Administrative Hearings (DOAH) instead of in a traditional court of law.

While Citizens often characterizes this as an “alternative dispute resolution” process, it represents a dramatic change in how policyholders can enforce their rights.

Key Problems With DOAH Proceedings

DOAH proceedings differ significantly from civil litigation:

- Limited discovery compared to circuit court

- No jury trial

- Different procedural and evidentiary standards

- An administrative forum where Citizens is a frequent repeat participant

For many homeowners, this means reduced leverage, fewer procedural protections, and limited ability to fully develop their case.

Constitutional Concerns Raised by DOAH Enforcement

The use of DOAH to resolve insurance disputes has raised serious constitutional questions, including:

1. Right of Access to Courts

Florida’s Constitution guarantees citizens meaningful access to the courts. Forcing policyholders into administrative proceedings may restrict or condition that access, particularly when participation is not truly voluntary.

2. Due Process Violations

Administrative proceedings can limit a homeowner’s ability to:

- Conduct full discovery

- Present evidence to a jury

- Challenge insurer tactics on equal footing

When a state-created insurer mandates an administrative forum that benefits itself, due process concerns arise.

3. Imbalance of Power

Citizens is a government-backed entity that regularly litigates before DOAH. Policyholders, by contrast, are typically first-time participants facing unfamiliar procedures, thereby creating an inherent imbalance.

Several legal challenges have already questioned whether Citizens’ DOAH framework unlawfully shifts disputes away from constitutionally protected court structures.

Why Citizens’ Structure Makes These Issues More Serious

Unlike private insurers, Citizens Is backed by statute. Because it enjoys legislative protection and limited exposure to bad-faith litigation, Citizens operates with a procedural advantage that private carriers lack.

When a government-backed entity like this also controls the forum where disputes are resolved, the risk to policyholder rights is amplified.

Is Citizens Homeowners Insurance Good?

Citizens homeowners insurance may be “good” in one narrow sense: it provides coverage when no one else will.

But from a claims and legal-rights perspective, many homeowners find that Citizens is difficult to challenge because (i) it uses procedural defenses aggressively, (ii) it limits access to traditional courts, and (iii) it creates constitutional concerns when disputes arise.

For these reasons, Citizens is often not a good long-term solution for homeowners who want full legal protection when disaster strikes.

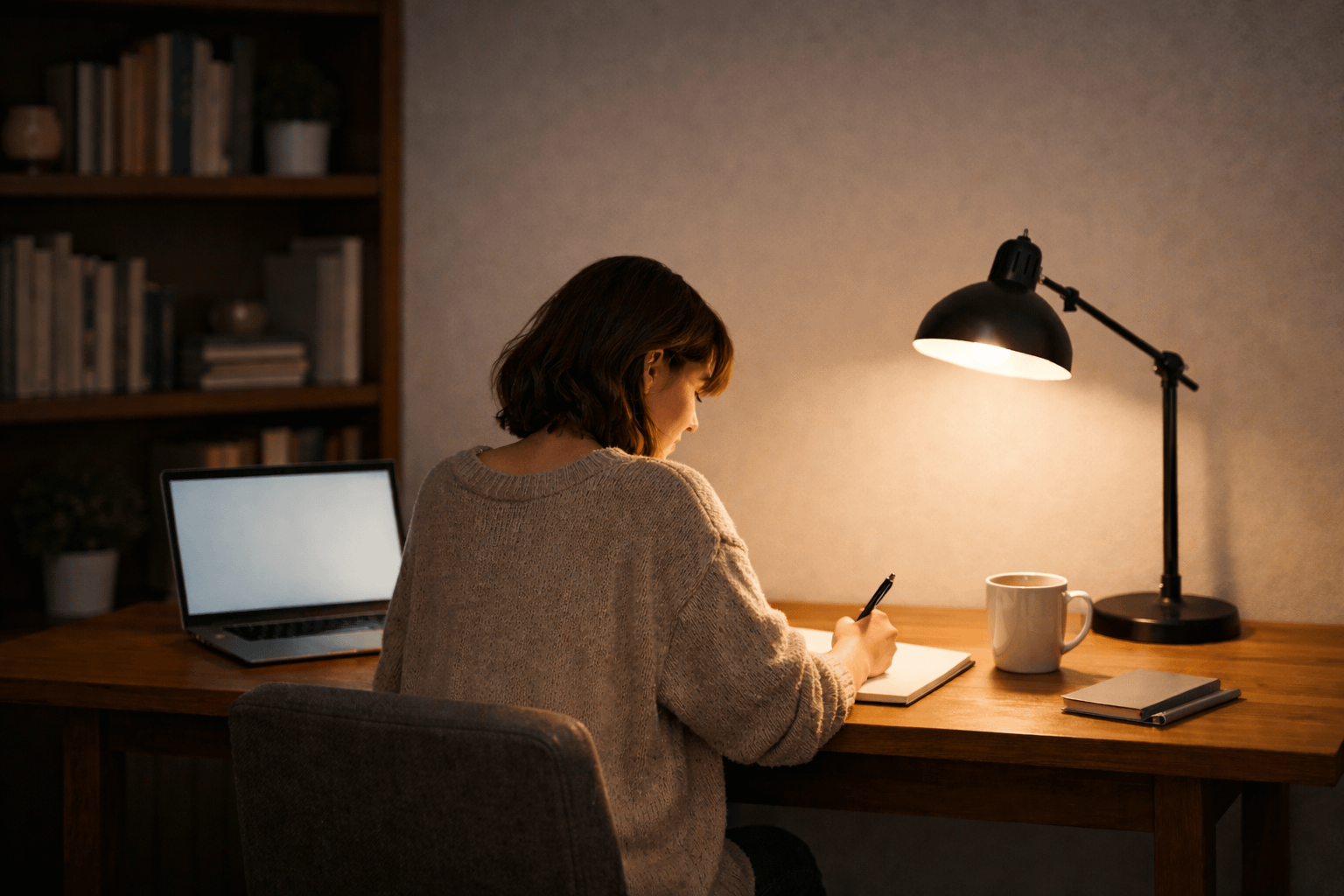

What Should Florida Homeowners Do To Protect Their Claim?

If you have a Citizens policy or a pending Citizens claim, as homeowners insurance dispute lawyers, we recommend you take the following actions:

- Review your policy carefully

- Do not assume you have the same rights as with a private insurer

- Be cautious about administrative dispute requirements

- Consult an experienced Florida insurance attorney early

Once a claim is forced into DOAH, your options may already be limited.

Final Thoughts on Citizens Homeowners Insurance

While Citizens remains a necessary safety net for availability, it often falls short in the areas that matter most: claims fairness and the protection of your constitutional rights. In 2026, the stakes have shifted. With Citizens increasingly pushing disputes into administrative forums like DOAH, the method of resolution is now just as important as the coverage itself.

As a Florida homeowner, you are no longer a passive participant. Don’t sign away your constitutional protections for a minor premium discount without understanding the legal consequences. Speak to a practicing insurance dispute lawyer near you today.