Table of Contents

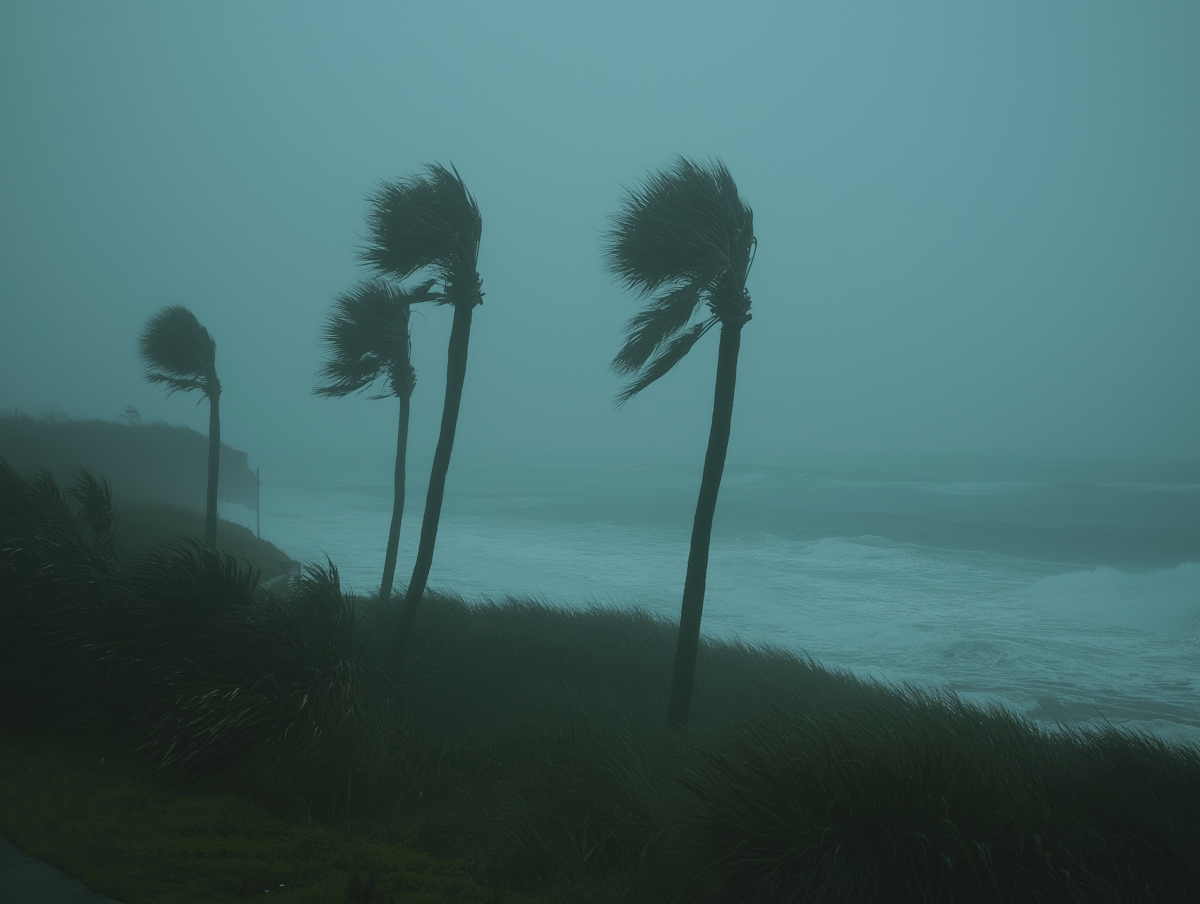

Florida lives with water. Afternoon downpours, stalled tropical systems, king tides, and hurricanes make flooding a regular risk across the state. Many homeowners carry flood insurance, yet when the time comes to file a claim, they are surprised to face stonewalling, low-ball offers, or flat-out denials.

Quick Overview: Getting Help After a Flood Damage

If your insurer is dragging its feet, refusing to pay you what you deserve, or blaming “pre‑existing” problems, it’s time to seek out legal guidance. At Levin Litigation, our Florida flood claim lawyers help property owners, from home and condo owners to businesses and community associations, fight back. Schedule a free case review with us to learn about your options and next steps.

What You Need to Know About Flood Damage Claims in Florida

In Florida, most standard home and business insurance policies do not cover flooding. To have coverage, you must purchase a separate policy either through the National Flood Insurance Program (NFIP) or a private flood insurer. This can come as a surprise to many property owners, and if your flood damage claim was denied, it’s important to first verify that you have the proper coverage.

Legally, flood damage is generally defined as a temporary or widespread inundation of normally dry land or property caused by rising waters, including:

- Rising water from rivers, lakes, or the ocean

- Coastal flooding or storm surges tied to hurricanes and tropical storms

- Heavy rainfall that collects and flows into buildings

- Mudflow or rapid runoff from nearby land

- Water entering through doors, windows, or foundation gaps caused by any of the above

In other words, flood damage typically involves water coming from outside your home or building, rather than leaks, burst pipes, or other internal water damage. Understanding this distinction can help you determine whether your loss qualifies for coverage under a flood insurance policy.

Why Insurance Companies Delay, Undervalue, or Deny Flood Claims

Insurers delay, deny, or undervalue claims for many reasons. Some are legitimate, but some are purely profit-driven. Understanding the common tactics helps you respond with evidence and avoid unnecessary setbacks.

- Causation disputes. Carriers often argue water entered through roof or window openings and call it “wind-driven rain” rather than flood. They may also blame pre-existing deterioration. When both wind and flood occurred, they may push responsibility to the other policy.

- Late notice or incomplete proof. If you wait to report your loss or you do not submit a signed proof of loss when required, expect delays or denials.

- Scope and pricing disagreements. Adjusters may miss hidden damage, underestimate material costs, apply improper depreciation, or refuse to match undamaged finishes.

- Exclusions and limitations. Claims can be cut down due to basement restrictions, exterior property exclusions, earth movement, or sewage backup.

- Documentation gaps. Limited photos, missing contents lists, or estimates that lack detail give the insurer room to underpay.

- Bad-faith tactics. Some carriers deliberately undervalue claims, misrepresent coverage, or otherwise stall in an attempt to save money.

In Florida, policyholders have the right to a timely claim decision. The law dictates that insurers generally must pay or deny claims within 60 days after notice, unless factors beyond their control prevent payment. In the case of an underpayment or denial, you also have the right to challenge the insurer’s decision.

How a Florida Flood Damage Claim Lawyer Can Help

After a flood, the damage is stressful enough, and sorting through insurance forms, documenting losses, and negotiating with the insurance company can feel overwhelming. A Florida flood damage claim lawyer can stand with you, making sure your rights are protected and your claim is treated fairly.

A lawyer can help you:

- Maximize your payout: Review your policy, identify missed coverage, and push insurers to honor the full claim.

- Challenge undervalued claims: Dispute lowball offers, improper depreciation, or misclassified damages to secure fair payment.

- Organize evidence effectively: Make sure photos, estimates, and documentation clearly support your losses so the insurer can’t downplay them.

- Navigate deadlines and rules: Ensure all notices and supplemental claims are filed correctly to avoid losing coverage.

- Handle disputes or escalation: Negotiate, pursue appraisal, or take legal action if the insurer refuses to pay what you’re owed.

Having a lawyer on your side can take the burden off your shoulders, keep the process moving smoothly, and increase the likelihood that you receive the full compensation your policy allows.

Why Choose Levin Litigation?

At Levin Litigation, property damage insurance claims are our bread and butter. Many of our attorneys have worked for property insurers, giving us unique insight into how claims are evaluated and the arguments you may face as a policyholder. We use that perspective to anticipate challenges and build stronger claims, ensuring your losses are fully documented and fairly presented.

We represent homeowners, condo owners, businesses, and associations across Florida in flood and storm-related claims and have recovered millions of dollars on their behalf. We offer free consultations and always work on a contingency basis, so you pay nothing unless we recover for you.

Flood Damage Insurance Claim Tips for a Smoother Claims Process

- Act quickly to limit further loss: Take reasonable steps to prevent additional damage. Prompt action can protect your claim and reduce disputes with the insurer.

- Notify your insurer promptly and track communications: Provide key details—policy number, date of loss, and a brief description—and maintain a log of calls, emails, and representatives you speak with. A clear record helps if disputes arise.

- Thoroughly document your property and belongings: Photograph or video each room, noting damaged structural components and personal property. Keep an organized list of items, including descriptions, quantities, and approximate value, to support your claim.

- Manage temporary repairs thoughtfully: Make essential repairs to prevent further damage, but preserve evidence of loss and keep receipts. This demonstrates diligence without creating disputes over unnecessary repairs.

- Maintain clear, professional communication: Provide organized documentation, summarize key points in writing, and keep all correspondence factual. Clear records reduce misunderstandings and make it harder for the insurer to underpay.

Get in Touch With Our Florida Flood Insurance Claim Lawyers

If your insurer is delaying, underpaying, or denying your Florida flood damage claim, Levin Litigation is ready to help. Our team handles claims across the state for many types of properties, from single-family homes to condos, townhomes, and mixed-use buildings. The sooner we get involved, the faster we can protect evidence, manage inspections, and push for the full value of your loss. Take advantage of a free consultation to understand your options and protect your rights.