Table of Contents

As attorneys who have handled numerous insurance disputes in Florida, we are frequently asked whether Citizens Property Insurance Corporation represents a viable option for homeowners. The answer, like most legal questions, is: it depends. Let us walk you through what we’ve observed in our practice and what the data tells us.

What Is Citizens Insurance?

To understand your rights as a policyholder, you must first understand what Citizens actually is and its unique position in Florida’s insurance landscape. Citizens is not a traditional private insurer competing for your business. Citizens was created by the Florida Legislature in 2002 as a nonprofit, government-backed entity – essentially the insurer of last resort. Think of it as the state’s acknowledgment that Florida’s property insurance market had become so volatile that some homeowners were denied coverage through normal channels.

From a legal standpoint, this matters. Citizens Property Insurance Corporation (or simply, Citizens) operates under different constraints than private insurers. It’s governed by statute, overseen by a Board appointed by state officials, and subject to legislative mandates that can change with political winds. When you’re dealing with Citizens, you’re not just dealing with an insurance company; you’re dealing with a governmental entity bound by public policy considerations that may or may not align with your individual needs. Understanding this shift in dynamic is essential if you ever need to file a claim or challenge an adjustment.

The Financial Strength Question: Can Citizens Actually Pay Your Claim?

When clients ask us if Citizens can actually pay claims, I point to the ratings. Citizens holds an A rating from AM Best, along with favorable ratings from Standard & Poor’s and Moody’s. These are solid marks that indicate financial stability. However, there’s a catch that policyholders need to understand.

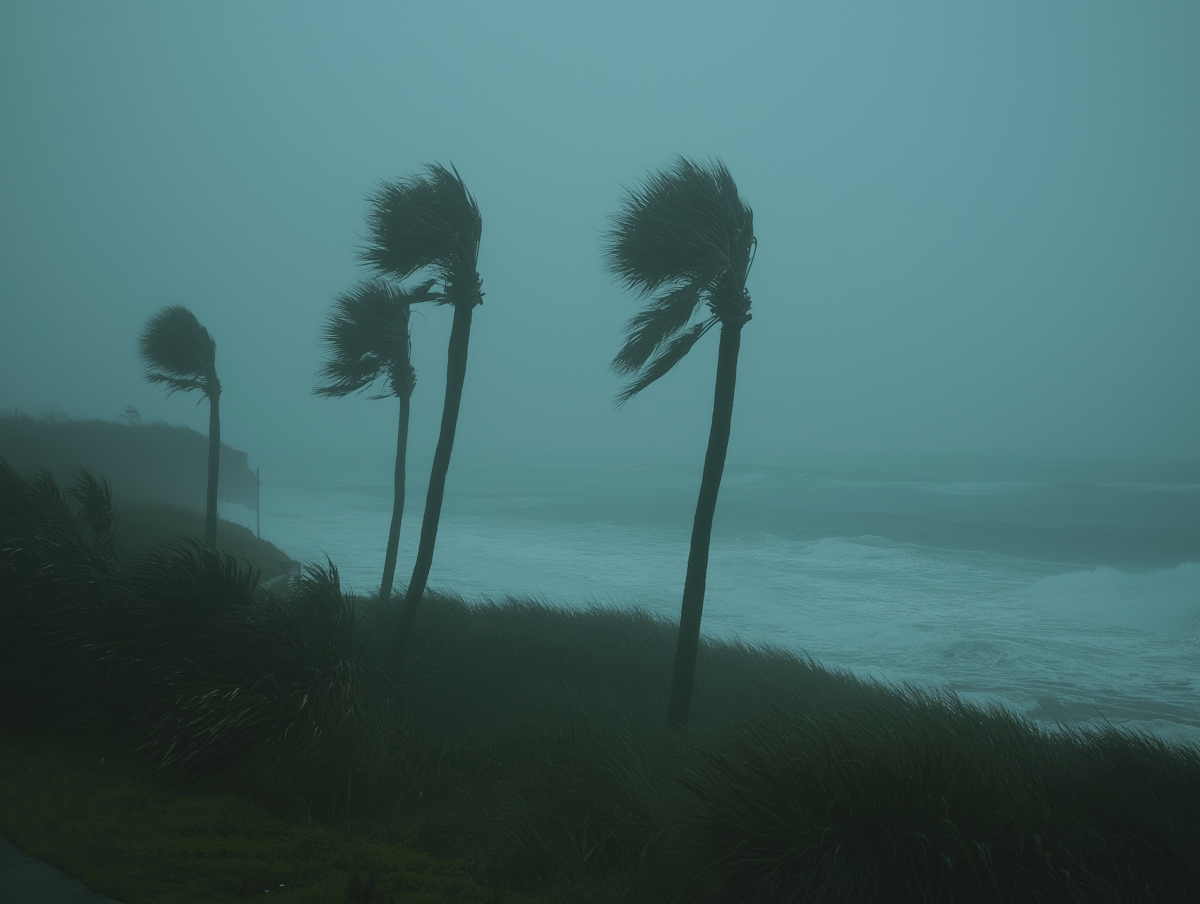

Citizens has a statutory mechanism that allows it to assess all Florida property insurance policyholders (not just its own customers) if it faces a deficit after major catastrophes. This means that if a massive hurricane season depletes Citizens’ reserves, every property owner in Florida with any kind of insurance could face surcharges to replenish those funds.

This essentially means you are entering a risk-sharing system that spreads potential losses across the entire state’s insurance market.

From a legal perspective, you need to understand this before you sign up. You’re not just buying a policy; you’re entering into a system where your financial obligations could extend beyond your premium if things go badly wrong.

Customer Experience: From Claims to Courtrooms

We’ve represented clients in disputes with various property insurers, and we can tell you that complaint data matters. The National Association of Insurance Commissioners tracks complaints against all insurers, and the picture with Citizens is mixed.

Some sources report that Citizens receives fewer complaints than the industry average relative to its size. Other analyses show elevated complaint levels, particularly regarding claims handling. Having reviewed the Better Business Bureau records and consumer complaint sites, I see recurring patterns: disputes over claim valuations, frustration with the claims adjustment process, allegations of delayed payments, and conflicts over coverage interpretations.

What strikes us as significant is the nature of the complaints. Many involve fundamental disagreements about what’s covered and how damage should be valued — the kind of disputes that often end up in mediation or litigation. I’ve seen cases where field adjusters and policyholders had vastly different assessments of storm damage, leading to protracted disputes.

That said, we’ve also encountered satisfied Citizens policyholders who received fair treatment on their claims. The variability suggests that outcomes may depend heavily on the specific adjuster assigned, the complexity of the claim, and how well the policyholder documents their loss.

Can Citizens Insurance Deny Coverage In Florida?

From a coverage standpoint, Citizens offers more basic protection than many private carriers. The policy forms are relatively standardized, and there’s less room for customization. Coverage caps exist for higher-value homes, which can leave affluent homeowners underinsured.

Here’s what concerns us from a legal perspective: Citizens requires policyholders to carry separate flood insurance. Given that water damage is often the subject of coverage disputes (particularly the difference between flood and wind-driven rain), having two separate policies with potentially different carriers makes things complex. In fact, we’ve handled cases where determining which policy applies became its own legal battle.

Additionally, Citizens has been known to conduct property inspections and can cancel policies or increase rates based on their findings. While this is within their contractual rights, it can put policyholders in difficult positions, especially if they’ve already been denied by private insurers.

The Eligibility Hurdle With Citizens Insurance

You can’t simply choose Citizens. To qualify, you generally need to demonstrate either that:

- you’ve been denied coverage by at least one private insurer, or

- that private coverage would cost more than twenty percent above what Citizens charge

This gatekeeping function is intentional because the legislature wants Citizens to be a last resort, not a first choice.

This creates an interesting legal dynamic. Citizens isn’t trying to attract customers; it’s trying to move them to private insurers whenever possible through what’s called “depopulation” efforts.

If a private insurer offers to take over your policy, you may be required to accept it, even if you’d prefer to stay with Citizens.

So, Is Citizens a Good Insurance Company?

Here’s our professional assessment:

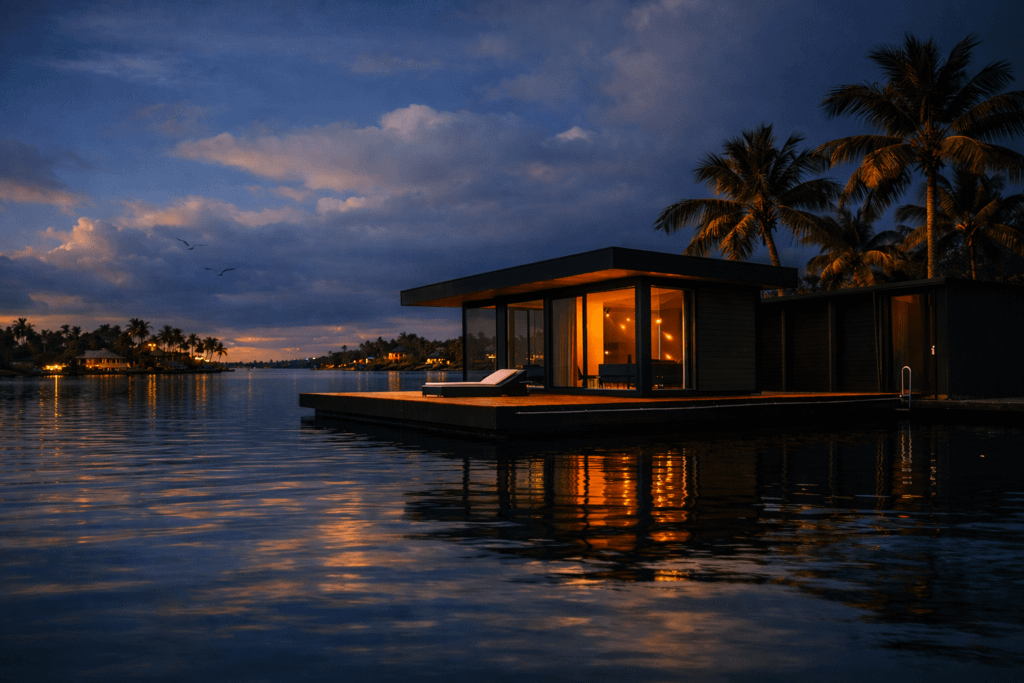

Citizens is a necessary option, not necessarily a preferred one. If you’re in a high-risk coastal area, have an older home, or have been denied by private carriers, Citizens may be your only realistic choice for property coverage. In that context, having coverage through Citizens is certainly better than being uninsured.

However, if you have access to comparable private insurance at reasonable rates, then we generally advise clients to explore those options first. Private insurers typically offer more flexibility in coverage, better customer service infrastructure, and don’t carry the same potential for policyholder assessments after catastrophes.

The financial ratings are reassuring, but they don’t tell the whole story. Citizens operates in one of the most challenging insurance markets in the country, insuring properties that other companies have declined. That concentration of risk is inherent to its mission, but it also means you’re dealing with an insurer that may face extraordinary claims in any given hurricane season.

Practical Advice For Florida Homeowners

If you find yourself with a Citizens policy, here’s what a property insurance lawyer recommends:

- Document everything meticulously. Photograph your property thoroughly, maintain detailed home improvement records, and keep copies of all correspondence with Citizens. If you ever need to file a claim, documentation becomes your most important asset.

- Understand your policy completely. Don’t assume coverage exists for a particular peril. Read the exclusions carefully, and if something is unclear, get clarification in writing.

- Consider supplemental coverage where it makes sense. If your dwelling coverage seems insufficient, explore whether additional insurance or endorsements would help close gaps.

- If you have a claim dispute, don’t hesitate to seek legal counsel early. Florida has specific statutes governing property insurance disputes, including provisions for mediation and attorney’s fees in certain circumstances. Understanding your rights can make a substantial difference in the outcome.

Book a Free Consultation With a Florida Property Insurance Attorney

Citizens Property Insurance Corporation serves a crucial function in Florida’s insurance ecosystem. It provides coverage to homeowners who might otherwise face impossible choices. The financial ratings suggest it can meet its obligations, and some policyholders report satisfactory experiences.

However, it’s important to approach Citizens with clear eyes. This is an insurer created to handle risks that the private market declined. Expect a more bureaucratic process, less personalized service, and potential complications in claims handling. Know your policy terms, understand the complaint patterns, and be prepared to advocate for yourself if disputes arise.

In our experience, the quality of your outcome with Citizens often depends on how well-prepared you are, how thoroughly you understand your coverage, and how effectively you can document your claim. It’s not the kind of insurance relationship where you can simply pay your premium and assume everything will work smoothly if disaster strikes.

Is Citizens a good company? We say it’s a functional one that serves a specific purpose in a difficult market. Whether it’s the right choice for you depends entirely on your alternatives — or lack thereof.

Book a free consultation with our team at Levin Litigation to learn more about how we can help you with your insurance dispute.